HP’s Most Difficult Challenge Has Yet to Hit

To date the cloud has not been a major disruption in the traditional outsourcing market. Rather, cloud has attacked the rogue IT or departmental processing market. But we believe that this tide will now turn inward onto the enterprise space, where HP and other infrastructure players live.

How will HP take on cloud disruption? We at Everest Group believe that it is highly likely that over the next three years 30 percent of the existing workloads will move out of the traditional outsourcing space and shift to cloud models. If this proves true, the substantial turnaround work that HP has done to date will not prove adequate to stem this new source of competition and disruption.

The results to date

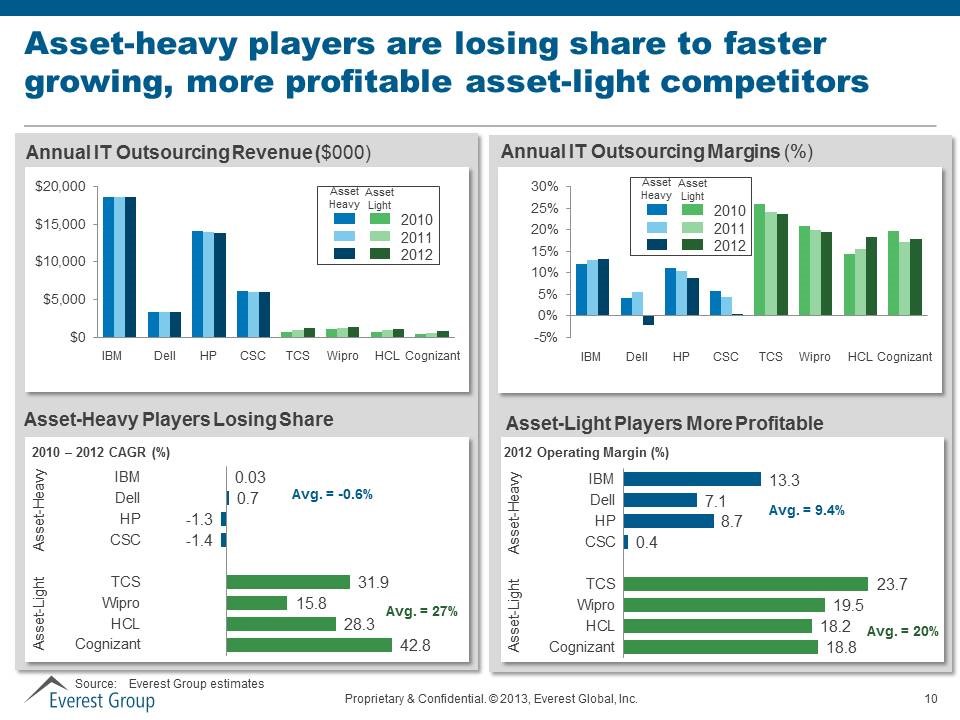

As shown in the figure below, CSC, Dell, HP and IBM have significant portfolios of asset-heavy IT infrastructure outsourcing deals. The statistics below clearly evidence the fact that the asset-heavy providers are losing share to asset-light players.

So far, the primary attack on the traditional space has been the RIMO (Remote Infrastructure Management Outsourcing) talent-only model.

Performance progress

When Meg Whitman took the reins as CEO, HP started the long process of turning around its business. Recommitting to the services space, she appointed Mike Nefkens as EVP and Enterprise Services general manager a seasoned veteran of EDS who quickly made progress in improving morale and in addressing customer satisfaction issues in existing service accounts. Market share losses slowed and HP reemerged with more competitive offerings and a can-do attitude. But have they fought the enemy to a standstill only to find they have a new front with a more deadly enemy.

Like a stone dropped on glass, RIMO competitors smashed the asset-heavy business. What will the new disruption of cloud do to it if — as we predict — it drives a 30% + run-off of workloads?

Photo credit: Don Debold